When you woke up in the morning on 29th Oct 2021, you must be surprised to notice that Facebook has changed its logo into an infinite loop ∞, and its name to meta, thus announcing its official entry into the Metaverse. Instantly the stock markets reacted with a bang as metaverse related stocks Roblox, Nvidia and Unity spiked significantly. Compared to the stock market, the crypto market reacted even more dramatically. The blockchain metaverse pioneer Decentraland governance coin MANA rose from $1 to about $4, i.e., 400% gain within four days. Another metaverse coin SAND (The governance coin of the SandBox) from $0.9 to 2.6, about 290% gain in the same period. In addition, GALA and MBOX also spiked significantly.

In recent months, the term metaverse has sort of become the newest buzzword in the crypto and gaming space, and startups venturing into Metaverse are mushrooming around the Globe. These startups were able to attract investments from angel investors and VCs. The biggest news this year was the direct listing of Roblox on the New York Stock Exchange which the company’s stock closed at $69.50 per share, giving the company a market cap of $38.26 billion. Another sensational story was Epic Games, the company that built Unreal Engine and the popular metaverse game Fortnite has just completed a 1 billion round of funding to support the long-term vision for the metaverse.

However, the most mind blogging news was the announcement by Mark Zuckerber that he wants to transform Facebook into a metaverse social media platform , even changing its name. In fact, when you woke up on 29th Oct 2021 , you will notice that Facebook has changed its logo into an infinite loop, signaling its entry into the Metavese. With Facebook going insanely big on Metaverse, and everyone so closely tied to Facebook, what will be the impacts on our personal life socially , economically and perhaps psychologically? We will no longer interacting in a 2D world but a VR, AR and XR mixed reality parallel world where you can meet your friends face to face, representing by your Avatars. However, things can turn ugly if you are not careful, friends you hate may suddenly appear and say hello to you, and he may just stab you from the back, though only your Avatar…

Metaverse is a term that first appeared in science fiction. The prefix “meta” means beyond, and “verse” means universe. The term was coined in Neal Stephenson’s 1992 science fiction novel Snow Crash, where humans, as avatars, interact with each other and software agents, in a 3D virtual space that uses the metaphor of the real world(Wikipedia). Fast forward to 2011, Novelist Ernest Cline authored a famous science fiction, Ready Player One, which hits theaters in March courtesy of Steven Spielberg. While the story is set in the strife-torn meatspace of 2045, most of its action unfolds in a vast network of artificial worlds called the OASIS, an earlier version of metaverse.

The recent popular Netflix short series “The Billion Dollar Code” that was based on the true story also tell us that the early concept of Metaverse has indeed started to materialized in the 1990’s. Although the Virtual Reality technology was called Terravision invented by a group of artists and computer nerds in Germany, it is indeed the 3D virtual map that allows you fly and zoom in to any part of the world in real time. It was alleged that Google stole the technology to create Google Earth though the case Art+Com vs Google of patent infringement was rejected by a US court.

Metaverse would not have been possible without the invention of the Internet, in particular the World Wide Web that allows global citizens to access and share multimedia contents around the globe. On the 6th of August 1991, Tim Berners-Lee posted the very first public invitation for collaboration on the World Wide Web, the beginning of the connected world where people are connected and access information and enjoy multimedia entertainment, even monetize from it. It was also the era of the browser war involving Netscape, Mozilla Firefox, Microsoft Internet Explorer, Safari and more. Without a browser you could not access the web. Eventually IE won the war but lost to Chrome in the 21st century.

The early world wide web was just providing multimedia content, non-interactive and did not allow any tom dick and harry to create a website, you must be a little bit tech savvy to use the HTML code to create a webpage. This era is generally known as Web 1.0. Besides, the computer processors were much less powerful than even today’s mobile phone , coupled with slow Internet speed using the dial-up modem, accessing the web was a painful experience. It is no wonder Terravision encountered a lot of issues due to the limitation of the hardware and Internet bandwidth. Despite the limitations, many dotcom companies were formed trying to monetize from the web, even some early online business platforms were developed to facilitate online commerce, which later known as e-commerce. Some famous examples were eBay and Amazon.com. Internet Giants Google , Facebook and Alibaba were not even born yet.

Entered the 21st century, many dotcom companies and startups went bust as a result of the dotcom bubble happened at the end of the 20th century, leaving a few giants like Amazon.com and the struggling Yahoo! to carry the torch. However, the Internet infrastructure has become more robust with the invention of faster modem, router and other hardware and much more powerful computers and laptops. In addition, connecting to the Internet has become seamless as WiFi replaced the old dial up modem. Besides that, touch screen mobile phones were becoming ubiquitous , making mobile web possible. Now people can stay online 24/7. It is also the emergence of search engine giant Google followed by the social media giant Facebook. Users are not only able to access the information, they can create and publish contents easily via social media and interact with other users. The interactive web is hence known as web 2.0.

Early 21st century also saw the emergence of massively multiplayer online role-playing game (MMORPG) . It is a video game that combines aspects of a role-playing video game and a massively multiplayer online game. This type of game allows players to immerse themselves in a virtual world so it can be considered a precursor of Metaverse game. MMORPGs are stark different from single-player or small multi-player online RPGs by the number of players able to interact together, and by the game’s persistent virtual world which continues to exist and evolve even while the player is offline and exit the game.

Since many massively multiplayer online games share features with the Metaverse but provide access only to non-persistent instances that are shared by up to several dozen players, the concept of multiverse virtual games has been used to distinguish them from the Metaverse.

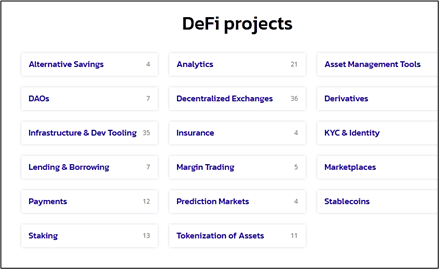

In the NFT space, it refers to shared virtual worlds where land, buildings, avatars and even names can be bought and sold using cryptocurrency. In these environments, people can wander around, play games, visit buildings, buy goods and services, and attend events, exactly like the real world. Let us examine some popular Metaverse NFT platforms. Metaverse has gained increasing popularity due to combination of NFT, DeFi and GameFi that form the in backbone of the Metaverse ecosystem.

To learn more about metaverse, please come back in my blog to check on updates on my current book publication date, the title is “Metaverse Made Easy: A Beginner’s Guide to the Metaverse: Everything you need to know about Metaverse, NFT and GameFi “

References

- https://www.mastercard.com/news/perspectives/2021/ecommerce-in-the-metaverse/4

- https://thenewstack.io/metaverse-developers/

- https://finance.yahoo.com/news/metaverse-travel-agency-m-t-130000683.html

- https://101blockchains.com/blockchain-metaverse/

- https://mvsdna.com/#/

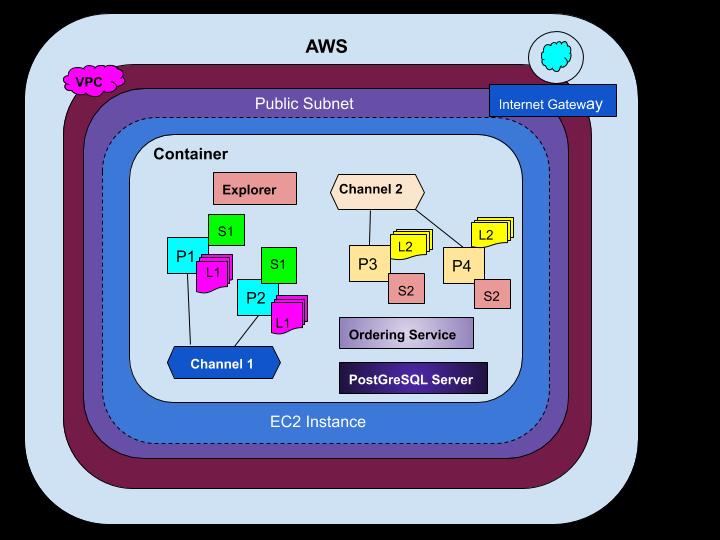

- https://aws.amazon.com/solutions/case-studies/viewfin/

- https://medium.com/building-the-metaverse/the-metaverse-value-chain-afcf9e09e3a7

- https://coinyuppie.com/in-depth-analysis-of-metaverse-how-nft-is-building-the-future-metaverse/

- https://www.themekaverse.com/

- https://en.wikipedia.org/wiki/Metaverse

- https://futuristspeaker.com/future-trends/the-history-of-the-metaverse/

- https://en.yna.co.kr/view/AEN20210518003500320

- https://venturebeat.com/2021/01/28/metaverse-startups-must-heed-the-mistakes-of-the-past-40-years-of-virtual-worlds/

- https://venturebeat.com/2021/03/10/roblox-goes-public-at-42-2-billion-valuation-in-direct-listing/

- https://www.archdaily.com/968905/architecting-the-metaverse