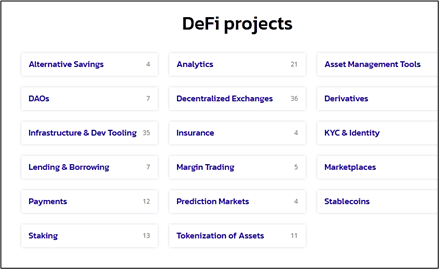

In this article, I shall discuss the types of DeFi products and services available in the crypto markets. Popular DeFi products include decentralized exchanges, loan and savings markets, tokenized physical assets such as gold, derivatives, forecasting/betting markets, payment, insurance, asset management, and more.

The complete list of DeFi products are as shown in the following Figure.

DeFi loan and savings markets allow you to lend, borrow, or deposit money in a platform. Among the popular loan and savings platforms are Compound, Aave, MakerDAO, Fulcrum, dYdX, and more. If you lend out your digital assets by depositing them in a liquidity pool, you will earn interest over a period. On the other hand, you can borrow a digital asset by giving another digital asset as a collateral. The collateral is usually ETH but can be other cryptoassets. The debt has an accruing interest which is to be paid off along with the principal.

Decentralized exchanges or DEXs are like stock exchanges but run by smart contracts on the Ethereum blockchain. While both allow you to trade assets, decentralized exchanges only trade cryptoassets and do not require centralized authorities to manage the trading. They run on autopilot 24/7. Therefore, it offers fantastic opportunity to anyone in the world to have access to invest in digital assets, particularly the unbanked and underserved.

In a nutshell, DeFi products allows you to use your digital assets to secure a loan and use that loan to invest in some other digital assets that you expect to gain higher returns. You may also leverage on your collateral to secure more loans to purchase more assets with the expectation that the value of the assets will appreciate, not unlike real estate investment. Besides, you can lend your assets in a lending and borrowing market to earn more attractive interest than banks.

In addition, you may contribute your assets to liquidity pools in the DeFi money market to earn rewards. If your risk appetite is high, you may trade with margin in many different types of Decentralized exchanges. You can even expose yourself to higher risk by leveraging. The list goes on, so do not miss the opportunities!